2022 and the Crypto Winter

The cryptocurrency markets have taken a huge hit in 2022. 67% of all cryptocurriences have lost over 99% of their value. Bitcoin has lost over half of its value in the first 6 months of 2022 alone. Ethereum is struggling to hold the hugely important $1,000.00 support. So, are the cryptocurrency and NFT markets dead, or are the rumors of their death greatly exaggerated? Here, we take a look at the recent bear market action in the world of NFTs and cryptocurriences and attempt to answer the question: can cryptocurrencies survive the 2022 recession?

Cryptocurrencies have been hit hard in 2022.

Cryptocurrency: Inflation and Correlation

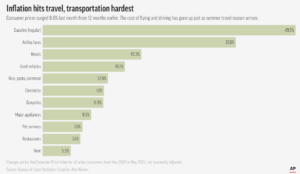

Inflation is the buzzword of 2022. It is everywhere. Gasoline prices are up nearly 50% since 2021. Airline fares are up almost 40% and even groceries are up almost 12% year-over-year. As the Federal Reserve continues to fight inflation with the only weapon it has, e.g., increasing the prime interest rate, the economy is almost surely heading towards its first recession since 2008. In the cryptocurrency and NFT world, the correlation between cryptos and the stock market is the most unsettling. Indeed, the correlation between the price of bitcoin and the NASDAQ is at or around .78. For context, a 1.00 correlation would be a perfect correlation. This tightly woven correlation is a horrific sign for crypto if the economy is heading towards a recession.

The inflation of 2022.

Many thought that the cryptocurrency markets – and bitcoin in particular – would be a bet against inflation. However, the events of the past few months have made this hypothesis look more like complete speculation than fact. What does this mean for the future of bitcoin and the cryptocurrency markets? First, one must rid themselves of the idea that bitcoin is a bet against inflation. This hypothesis has proven to be false. We have not seen inflation numbers like these in 40 years, and the cryptocurrency markets got hammered with the inflationary news. Accordingly, there seems to be no relationship and no correlation between inflation and the cryptocurrency markets.

Cryptocurrency Bear Market is Everyone’s Bear Market

A glaring notion screaming from the recent headlines is that the entire world is in a bear market. The U.S. economy is almost certainly heading for its first recession in almost 15 years. In fact, some U.S. businesses and consumers are already certain the recession has already begun. From Great Britain to Canada, there is no stock market or economy that is immune from the bear market cycle of 2022. What does this mean for the NFT and cryptocurrency markets? There are some interesting nuggets to take away from the 2022 Crypto Winter.

A Bet on Crypto is a Bet on Technology

The correlation between bitcoin and the stock market is a new phenomenon. In fact, prior to the COVID-19 pandemic, there was little to no correlation between bitcoin and that stock market. Currently, the economic conditions of the world markets have created a perfect storm. No asset class has been safe from huge losses. While the cryptocurrency depreciation has been extreme, there is hope to believe that this recent correlation to the markets is only a short-term blip.

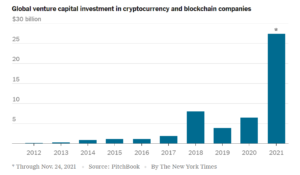

Big Money is All-In

In 2021, venture capital investment in cryptocurrency and blockchain companies rose to over $27 billion. This is an astronomical increase over the past 10 years, and just one sign that “big money” is heavily invested in the future of cryptocurrency. A fact that cannot be discarded as a distinguishing factor between this bear market and the bear markets of yesterday. Further, institutions like Goldman Sach and Bank of America have changed their perspective on cryptocurrency since the bear markets in the earlier part of the 21st Century. Indeed, Bank of America recently stated that bitcoin and other digital assets are simply too big to ignore. This was not the case the in 2013. These and other factors seem to distinguish the Crypto Winter of 2022 versus the other bear markets that have come before.

VC Investment in Cryptocurrency in 2021.

Cryptocurrency’s Future

As the recession of 2022 settles in and bitcoin remains above the critical support of $20,000.00, the question becomes what is next for the cryptocurrency markets in the final quarters of 2022, and the beginning of 2023. Currently, with the cryptocurrency markets tightly correlated to the NASDAQ and technologic stocks, it seems that patience must be in order. Indeed, there is almost no economist in the world that is bullish on the stock markets in the short-term. However, these are extraordinary times. If we pull-back and look at the world’s economies prior to the pandemic, we see that bitcoin’s correlation with the stock market is an anomaly.

Further, with the world economies and their stock markets seemingly bearish for years to come, diversifying into the cryptocurrency markets – where huge growth is still possible – could be a viable alternative for investors. Venture Capitalists do not put all their cash into sinking ships.

Thank you for reading our blog post. Continue to check us out for more information and resources on all things NFTs – including our own NFT project, Awk Monks! Also, don’t forget to check out The Ultimate NFT Monkey Guide for all things NFT Monkey related.