NFT Art and the Crypto Winter of 2022

The crypto winter of 2022 is here. Bitcoin and other cryptocurriences have fallen sharply since their all-time highs of 2021. NFT Art sales have plummeted over the past six months. Indeed, NFT sales volume on OpenSea in January of 2022 was $5.8 billion. In September of 2022, the same NFT sales volume fell dramatically to just $349 million. A drop in sales of approximately 93%. While the short-term market may be caught by the winds of inflation and fears of recession, one might wonder if there is any room for optimism. Here, in this blog post, we examine why the cryptocurrency prices have fallen so drastically, and what the future holds for the crypto and NFT Art space.

NFT Art: Inflation and Correlation

Inflation is the buzzword of 2022. It is everywhere. Gasoline prices are up nearly 50% since 2021. Airline fares are up almost 40% and even groceries are up almost 12% year-over-year. As the Federal Reserve continues to fight inflation with the only weapon it has, e.g., increasing the prime interest rate, the economy is almost surely heading towards its first recession since 2008. In the cryptocurrency and NFT world, the correlation between cryptos and the stock market is the most unsettling. Indeed, the correlation between the price of bitcoin and the NASDAQ is at or around .78. For context, a 1.00 correlation would be a perfect correlation. This tightly woven correlation is a horrific sign for crypto if the economy is heading towards a recession.

NFT Art: A Bet on Crypto is a Bet on Technology

The correlation between bitcoin and the stock market is a new phenomenon. In fact, prior to the COVID-19 pandemic, there was little to no correlation between bitcoin and that stock market. Currently, the economic conditions of the world markets have created a perfect storm. No asset class has been safe from huge losses. While the cryptocurrency depreciation has been extreme, there is hope to believe that this recent correlation to the markets is only a short-term blip.

Big Money is All-In

In 2021, venture capital investment in cryptocurrency and blockchain companies rose to over $27 billion. This is an astronomical increase over the past 10 years, and just one sign that “big money” is heavily invested in the future of cryptocurrency. A fact that cannot be discarded as a distinguishing factor between this bear market and the bear markets of yesterday. Further, institutions like Goldman Sach and Bank of America have changed their perspective on cryptocurrency since the bear markets in the earlier part of the 21st Century. Indeed, Bank of America recently stated that bitcoin and other digital assets are simply too big to ignore. This was not the case the in 2013. These and other factors seem to distinguish the Crypto Winter of 2022 versus the other bear markets that have come before.

NFT Art: Still Standing

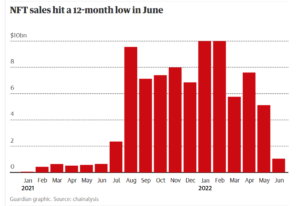

The NFT Art market peaked in January 2022 with sales topping $10 billion. Sales in June of 2022 peaked just over $1 billion. These numbers certainly suggest a downtrend in the NFT Art market. Yet, this downward movement has not been occurring in isolation. There have been numerous outside factors that have negatively impacted the NFT Art Market.

First, that the traditional art market goes through bull and bear cycles, but it is a strong market that has survived for hundreds of years. The reason the traditional art market has survived is because of the art itself.

NFT Sales January 2021 to June 2022.

Second, the crypto winter of 2022 has caused all cryptocurriences to fall dramatically from their all-time high prices. NFTs are priced in crypto, so this has of course negatively impacted the price of NFT Art. But the rumors of the death of crypto have been greatly exaggerated. The macro-economic news has had a negative impact on the entire economy. Nothing has been insulated from the inflationary and recession news. But the worst of the crypto winter may be behind us. Bitcoin has rallied from its recent lows of $18K to stay strongly above its support at $20K.

Third, in 2021 venture capital investment in cryptocurrency and blockchain companies rose to over $27 billion. This is an astronomical increase over the past 10 years, and just one sign that “big money” is heavily invested in the future of cryptocurrency. A fact that cannot be discarded as a distinguishing factor between our current market and the bear markets of yesterday. Further, institutions like Goldman Sach and Bank of America have changed their perspective on cryptocurrency since the bear markets in the earlier part of the 21st Century. Indeed, Bank of America recently stated that bitcoin and other digital assets are simply too big to ignore. This was not the case the in 2013. These and other factors seem to distinguish the Crypto Winter of 2022 versus the other bear markets that have come before.

Art With Utility

The traditional art market has survived for hundreds of years. This market has survived, in part, because owning certain pieces of art is a status symbol for the wealthy and well-connected. Now, with social media everywhere, this same wealthy individual can make their social media profile picture a one-of-a-kind piece of NFT art. Thereby proclaiming their status to millions of people. These types of NFTs are known of profile picture NFTs, or PFP NFTs. As the world becomes more and more digital, NFT PFP will become even more prevalent.

NFT Art does what traditional art does and then builds upon it. NFT Art can be aesthetically beautiful. It can express feelings and emotions. In other words, NFT Art can do exactly what traditional art can do. But NFT Art can do more than traditional art. Due to the blockchain technology that NFTs are built upon, NFT Art can provide utility and benefits to their owners. The utility and benefits that NFTs provide are not available to the traditional art owner.

Thank You for a Real Good Time!

Thank you taking the time to read our blog post! Continue to check out our blog for more interesting posts on the world of NFTs. Also, don’t forget to check out The Ultimate NFT Monkey Guide for everything NFT Monkey!